Making Sense of Mortgage Rates and Market Timing

Buying a home is one of the biggest financial decisions you’ll ever make, and mortgage rates play a huge role in determining affordability. Even a small change in interest rates can significantly impact your monthly payment and overall cost over time. With fluctuating rates and market uncertainty, many buyers find themselves asking: Should I buy now or wait?

While mortgage rates are a key factor in your decision, they aren’t the only thing to consider. Home prices, loan options, personal finances, and long-term plans all come into play. And no matter when you choose to buy, one thing remains constant: the need for title insurance to protect your investment. Let’s break down the latest mortgage rate trends, reasons to buy now versus later, and how title insurance ensures a secure transaction regardless of market conditions.

Understanding Mortgage Rate Trends

Mortgage rates are influenced by several economic factors, including:

- The Federal Reserve: While the Fed doesn’t directly set mortgage rates, its policies on inflation and interest rates affect them.

- Economic Growth & Inflation: When the economy is strong, rates tend to rise. If inflation is high, lenders increase rates to maintain profitability.

- Housing Market Conditions: Supply and demand for homes can impact borrowing costs.

- Global Events: Financial crises, pandemics, and geopolitical issues can cause rate fluctuations.

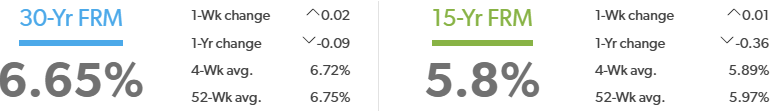

Where Are Mortgage Rates Now?

- Source: https://www.freddiemac.com/pmms

Experts have differing opinions on where rates will go next. Some predict gradual decreases if inflation slows, while others believe rates will stay elevated due to economic uncertainties.

How Title Insurance Fits In

Regardless of whether rates are high or low, securing title insurance is crucial. When interest rates fluctuate, markets shift rapidly—leading to rushed transactions, distressed property sales, and potential title issues. A comprehensive title search ensures you don’t inherit legal troubles from previous owners.

The Case for Buying Now

While high mortgage rates may make buyers hesitant, there are compelling reasons to move forward with a purchase:

1. Locking in a Rate Before Potential Increases

While some experts predict rates may decrease, there’s no guarantee. If inflation remains stubborn or economic conditions shift, rates could rise further—making homes even less affordable.

2. Home Prices Are Still Climbing

In many markets, home prices continue to rise due to limited inventory. Waiting for lower rates might mean paying a higher price later, negating any savings from a reduced interest rate.

3. Building Equity vs. Paying Rent

Instead of paying rent (which often increases yearly), homeownership allows you to build equity. Even if you buy at a higher rate, refinancing later can lower your payments while keeping your long-term investment secure.

4. Lender Incentives and Rate Buydowns

To counteract high rates, some lenders offer temporary rate buydowns or closing cost assistance. Taking advantage of these programs can make homeownership more affordable.

5. Title Insurance Helps in a Competitive Market

When buyers rush to close deals in a competitive market, title risks increase. Skipping a thorough title search can expose you to liens, ownership disputes, or legal claims. A title insurance policy ensures your rights are protected—so you don’t inherit problems from previous owners.

The Case for Waiting

On the flip side, some buyers might benefit from holding off on their purchase. Here’s why:

1. Mortgage Rates Might Drop

If inflation slows and economic conditions stabilize, rates could decrease. A lower rate means a lower monthly payment, potentially making homeownership more affordable.

2. Potential Market Cooldown

A slowdown in the housing market could lead to lower home prices, giving buyers more negotiating power. Waiting could result in a better deal, especially if inventory increases.

3. Strengthening Your Financial Position

Postponing your purchase gives you time to:

✔ Improve your credit score for a better loan rate.

✔ Save for a larger down payment, reducing borrowing costs.

✔ Pay down existing debt, improving your debt-to-income ratio.

4. Economic Uncertainty

If job stability or economic conditions concern you, waiting may be the safer choice. It’s better to buy when you feel financially secure rather than rushing into a high-cost commitment.

5. Title Risks in a Shifting Market

Market fluctuations can increase the risk of title issues, especially with foreclosures or distressed sales. A delayed purchase doesn’t mean skipping title protection—it means being even more diligent when the time comes to buy.

How to Decide: Key Factors to Consider

1. Your Financial Readiness

- Is your credit score strong enough for a good loan rate?

- Do you have a stable income and emergency savings?

- Can you afford the monthly mortgage, taxes, and insurance?

2. Local Market Conditions

- Are home prices rising or stabilizing?

- Is inventory limited or increasing?

- Are sellers offering concessions, or is it still a competitive market?

3. Long-Term vs. Short-Term Plans

- Do you plan to stay in the home for many years?

- Would you consider refinancing if rates drop later?

- Does buying now align with your personal and financial goals?

4. Title Insurance: A Non-Negotiable

No matter when you buy, a clear title is essential. A title search uncovers unpaid property taxes, old liens, or legal claims that could affect ownership. Valley Land Title Co. ensures that when you buy, you own your home free and clear—without unexpected legal issues.

Strategies for Buying in Any Market

Whether rates are high or low, these strategies can help make homeownership more affordable:

✔ Negotiate with Sellers: Ask for closing cost assistance or rate buydowns.

✔ Explore Different Loan Types: Consider ARMs (adjustable-rate mortgages) if rates are high.

✔ Plan for Refinancing: If rates drop, you can refinance later for better terms.

✔ Work with Experts: A knowledgeable real estate agent, mortgage lender, and title company can help you navigate the process.

And most importantly—protect your investment with title insurance.

Should You Buy Now or Wait?

There’s no universal answer to whether now is the right time to buy. If you’re financially prepared and find the right home, buying now could help you build equity and avoid rising prices. On the other hand, waiting might make sense if rates are expected to drop or if you need more time to strengthen your financial position.

Regardless of when you decide to purchase, title insurance is your safeguard against ownership disputes, unpaid debts, or legal complications. At Valley Land Title Co., we ensure your homeownership is protected, so you can buy with confidence—whenever the time is right for you.

Ready to Make a Move?

Contact Valley Land Title Co. today to learn how we can help you secure a smooth and protected home purchase.